Free Consultation: (619) 633-7778

Offers Video ConferencingTap to Call This Lawyer

Offers Video ConferencingTap to Call This Lawyer

PREMIUM

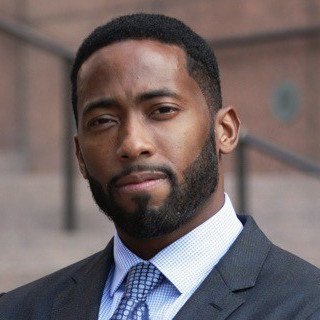

Tristan Brown

Lawyers, want to be a Justia Connect Pro too? Learn more ›

Lawyers, want to be a Justia Connect Pro too? Learn more ›

Over 2,000 bankruptcies filed ** BBB rating A+ ** Se habla Español

Badges

Claimed Lawyer ProfileOffers Video ConferencingQ&ALII Gold

Biography

T.L. Brown Law Firm was awarded an A+ by the Better Business Bureau. Filing over 300 cases each year, Attorney Tristan Brown remains a leading bankruptcy attorney in San Diego and the Southern California area.

Additionally, T.L. Brown’s estate planning and immigration law practices continue to grow.

Attorney Tristan Brown obtained his Juris Doctor degree from UCLA School of Law and quickly earned recognition as a leader in bankruptcy law. He was awarded "Rising Star" by Super Lawyers in 2021, 2022, 2023 and 2024.

Practice Areas

- Bankruptcy

- Chapter 13 Bankruptcy, Chapter 7 Bankruptcy, Debt Relief

- Immigration Law

- Citizenship, Family Visas, Green Cards, Marriage & Fiancé(e) Visas, Visitor Visas

- Estate Planning

- Health Care Directives, Trusts, Wills

Video Conferencing

- FaceTime

- Skype

- Zoom

- GoToMeeting

- Microsoft Teams

Fees

- Free Consultation

- Credit Cards Accepted

Jurisdictions Admitted to Practice

- California

- State Bar of California

-

- U.S. District Court, Northern, Southern & Central Districts of California

-

Languages

- English: Spoken, Written

- Spanish: Spoken, Written

Professional Experience

- Managing Attorney

- T.L. Brown Law Firm, P.C.

- - Current

- Office Manager and Attorney

- D|R Welch Attorneys

- -

- Executive Director

- The Trejo Law Corporation

- -

- Legal

- HBO

- Law Clerk

- The Gillam Law Firm

- Legal Intern

- Occidental Petroleum

Education

- UCLA School of Law

- J.D. (2008)

-

- University of California - Los Angeles

- B.A. (2004)

-

Awards

- Rising Star

- Super Lawyers

- 2021-2024

- Superb Rating

- Avvo

- Best Bankruptcy Attorneys in San Diego

- Expertise.com

- A+ Accredited Business Rating

- Better Business Bureau

- Top 40 Under 40 Attorney

- National Black Lawyers

Professional Associations

- State Bar of California # 298631

- Member

- Current

-

- San Diego County Bar Association

- Member

- Current

-

Publications

Articles & Publications

- Can I Protect My House and My Car In Bankruptcy?

- T.L. Brown Law Firm

- The California Bankruptcy Homestead Exemption Has Increased

- T.L. Brown Law Firm

- 6 Reasons Bankruptcy May Be a Good Idea

- T.L. Brown Law Firm

- 6 Reasons Bankruptcy May Not Be a Good Fit for You

- T.L. Brown Law Firm

Speaking Engagements

- Ep #2 Tristan Brown, SMP: Sunlight Media Podcast

Videos

Legal Answers

18 Questions Answered

- Q. Is my unborn baby considered part of California's Median Family Income? Or does that start at birth?

- A: By IRS standards, a child is not considered a dependent until it is born. It is my understanding that you would not include your unborn child as part of your overall household size until it is born.

Be sure to consult an experienced bankruptcy attorney in your state to determine how your current household size affects the Means Test.

- Q. Bankruptcy Question - I have vast amounts of credit card debt that I need to file...but I am also a homeowner.

- A: There is not enough information provided to answer your three questions, but I can provide some general information.

1. Even if a borrower did not execute a security agreement with an unsecured creditor, the unsecured creditor may possibly obtain a civil judgment against the borrower which enables the unsecured creditor to place a lien on real property.

2. There are situations where both an LLC and its owner are simultaneously liable for a debt. If the LLC and its owner share liability, the owner may possibly discharge his or her personal liability via the bankruptcy process. However, if the owner discharges the debt through the bankruptcy process, the LLC (as a separate entity) may continue ... Read More

- Q. Just wondering i have 10k in credit card debt how do i file for chapter 7

- A: Based upon the information provided, I am unable to determine whether bankruptcy is advisable in your situation.

Be sure to contact an experienced bankruptcy attorney in your state to discuss your bankruptcy options. Multiple factors are considered to determine if filing bankruptcy for debts amounting to $10,000 is recommended. You may also use that opportunity to discuss bankruptcy alternatives with an attorney.

Social Media

Contact & Map

TL Brown Law Firm Lobby Video SD 2024

TL Brown Law Firm Lobby Video SD 2024