Free Consultation: (844) 385-9611Tap to Call This Lawyer

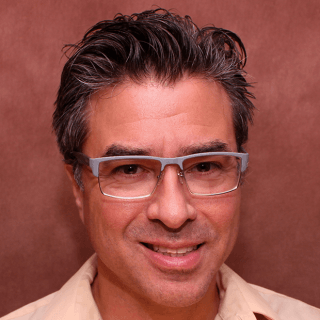

Ramon Olivencia

Online Attorney: Probate (Estate Law), Vital Records, Real Estate & Notary Law

Badges

Claimed Lawyer ProfileOffers Video ConferencingQ&AResponsive Law

Biography

As a fully bilingual lawyer and notary public, I specialize in estate law and real estate. My services cater to clients located in Puerto Rico and those from the diaspora abroad. With a wealth of experience working with the PR State Court of Appeals and the PR Department of Justice, I am licensed in PR and NY. I encourage all potential clients to visit our WEBSITE and fill out our online form to evaluate their case, as it is the only way to work together. All inquiries will be answered within 1-3 business days.

Practice Areas

- Probate

- Probate Administration

- Real Estate Law

- Commercial Real Estate, Easements, Mortgages, Residential Real Estate

- Estate Planning

- Guardianship & Conservatorship Estate Administration, Health Care Directives, Wills

Additional Practice Area

- Notary Public

Video Conferencing

Fees

-

Free Consultation

Free consultations ONLINE ONLY! - Credit Cards Accepted

-

Rates, Retainers and Additional Information

We accept credit cards, Zelle, Cash App, PayPal, Venmo, ATH Móvil, direct deposit, wire transfers, etc.

Jurisdictions Admitted to Practice

- New York

- New York State Office of Court Administration

- ID Number: 4992368

-

- Puerto Rico

- Colegio de Abogados y Abogadas de Puerto Rico

- ID Number: 14068

-

- 1st Circuit

- ID Number: 87407

-

- U.S. Supreme Court

-

- US District Court for the District of PR

- ID Number: 220502

-

Languages

- English: Spoken, Written

- Spanish: Spoken, Written

Professional Experience

- Attorney-at-Law / Notary Public

- Abogado Notario Online

- - Current

- Contract attorney

- Epiq (New York, NY)

- -

- Contract attorney

- Update Legal (New York, NY)

- -

- Attorney – Office of Legal Counsel

- Puerto Rico Department of Justice

- -

- Drafted legal opinions for the Attorney General in response to requests from the various agencies within the Executive Branch.

- Attorney – Office of Civil Litigation

- Puerto Rico Department of Justice

- -

- Represented the public sector on multiple judicial and administrative civil cases at both the state and federal court levels.

- Law Clerk

- State Court of Appeals

- -

Education

- University of Massachusetts - Boston

- M.S. | Public Administration

-

- University of Massachusetts - Amherst

- B.A. | Political Science

-

- University of Puerto Rico - Río Piedras

- General studies.

-

- Interamerican University of Puerto Rico School of Law

- J.D. (2001) | Law

-

Professional Associations

- American Bar Association # 00873955

- Member

- Current

-

- Puerto Rico Bar Association # 15234

- Member

- - Current

-

- Puerto Rico Judicial Branch # 14068

- Certified Attorney

- - Current

-

Publications

Articles & Publications

- Latino Politics in Massachusetts

- Routledge Press

Websites & Blogs

- Website

- Abogado Notario Online

Legal Answers

53 Questions Answered

- Q. My mom who is still alive, wants to donate her property and house in Puerto Rico but owes "CRIM", what can be done?

- A: The property tax exemption for residing at the main residence in Puerto Rico is not automatic. It has to be applied for and is only valid until a certain amount, although most residences in Puerto Rico, except the very expensive ones, qualify.

If she has a copy of the receipt of the original filing for when she bought the property (considering that she is the owner or co-owner with her husband, if any), then that is the best evidence for telling the CRIM to correct the error, if such was the case.

Typically, however, the closing attorney or bank, if any, is in charge of that, if the property was bought after 1991, which is when the CRIM was created.

If the form was never filed, then ... Read More

- Q. My mom owns a home in puerto rico damaged by Hurricane Maria. She wants to transfer deed to me. How and where do I start

- A: If your mother wants to transfer her house to you, she must sign a "donation" deed via an attorney, which both parties must sign. If one or the two of you cannot be present for the signing, then a Power of Attorney could be prepared. As part of the requirements for a donation, the attorney will first have to obtain a waiver from the Puerto Rico Treasury Department ("Departamento de Hacienda"), to make sure that there are no tax debts owed. If, on the other hand, the transfer involves a monetary exchange, that is, if she were to sell you the property, then a "sales" deed will have to be prepared instead.

- Q. Do I need an attorney to file a Declaration of Heirs in Puerto Rico?

- A: Due to the particularities and legal requirements needed for a Declaration of Heirs in Puerto Rico, an attorney is highly recommended. That way, you can rest assured that the petition is filed correctly before the courts. Any errors could negatively affect the rest of the documents that are typically filed afterward, such as the filings before the Puerto Rico Department of Treasury and, if applicable, the Property Registry. Those likely mistakes would then cost you additional money and time to fix them.

Social Media

Contact & Map

There are no recently viewed profiles.

There are no saved profiles.

There are no profiles to compare.